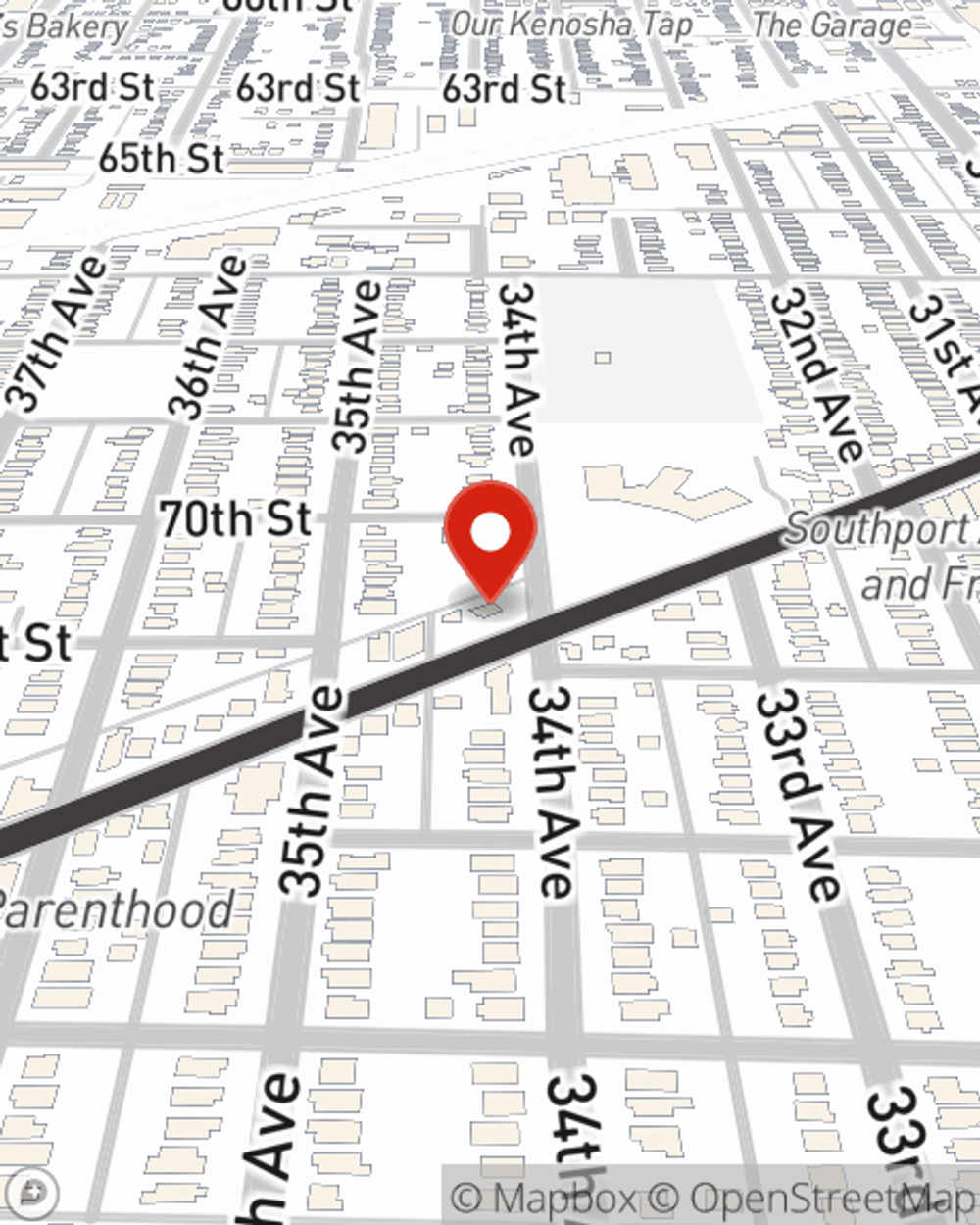

Business Insurance in and around Kenosha

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and errors and omissions liability, you can take a deep breath knowing that your small business is properly protected.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a tailoring service, an ice cream shop, or a pizza parlor, having the right protection for you is important. As a business owner, as well, State Farm agent Rob Fleming understands and is happy to offer personalized insurance options to fit what you need.

Ready to talk through the business insurance options that may be right for you? Contact agent Rob Fleming's office to get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Rob Fleming

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.