Renters Insurance in and around Kenosha

Your renters insurance search is over, Kenosha

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Kenosha Renters!

Home is home even if you are leasing it. And whether it's an apartment or a townhome, protection for your personal belongings is beneficial, especially if you own items that would be difficult to fix or replace.

Your renters insurance search is over, Kenosha

Rent wisely with insurance from State Farm

Safeguard Your Personal Assets

It's likely that your landlord's insurance only covers the structure of the space or townhome you're renting. So, if you want to protect your valuables - such as a cooking set, a guitar or a stereo - renters insurance is what you're looking for. State Farm agent Rob Fleming has the knowledge needed to help you choose the right policy and protect yourself from the unexpected.

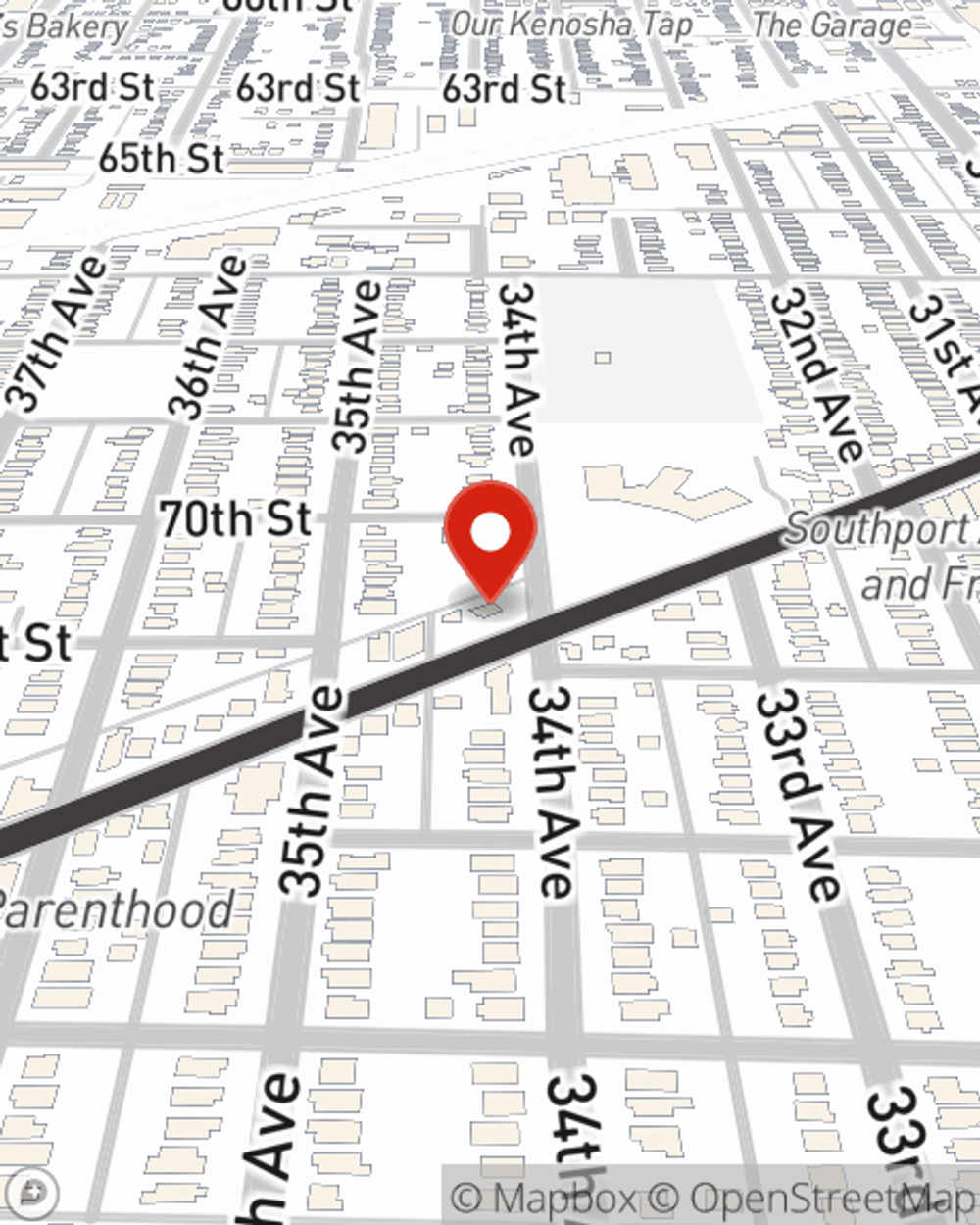

Get in touch with Rob Fleming's office to learn more about how you can benefit from State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

Call Rob at (262) 656-1414 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Rob Fleming

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.